Southern Silver Exploration Corp. (TSX.V:SSV) (“Southern”) reports that Kirkham Geosystems Ltd. (“KGL”) has completed an independent Mineral Resource Estimate on the Cerro Las Minitas (“CLM”) project in Durango State, Mexico. Electrum Global Holdings L.P. (“Electrum”) is financing a broad range of exploration activities to earn a 60% interest in CLM.

The resource estimate provides initial grade and tonnage estimates for three mineral deposits on the property at the Blind, El Sol and Santo Nino zones which have been the focus of much of Southern’s exploration activities on the property since 2011, but does not include mineralization from the newly discovered Mina La Bocona zone.

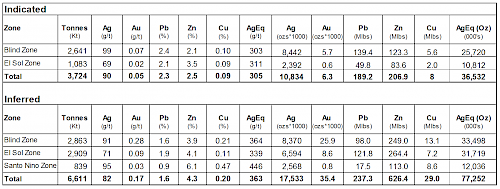

Table 1: Base-case Mineral Resource Estimate utilizing a 150g/t AgEq cut-off value is as follows:

The 150g/t AgEq cut-off value was calculated using average long-term prices of $15/oz silver, $1,100/oz gold, $2.75/lb Copper, $0.90/lb lead and $0.90/lb zinc and metal recoveries of 82% silver, 86% lead and 80% zinc. All prices are stated in $USD.

President, Lawrence Page Q.C. stated “Since May 2011, Cerro Las Minitas has developed from a prospect into a resource with great potential to become a significant economic deposit. Continued growth is expected along the 25 kilometres length of the 13,700 hectare property. We have succeeded, during one of the most severe bear markets in recent history, in purchasing the property for a cost of $US 3.6 million, conducted extensive geophysical evaluation and 32,719 metres of diamond drilling, at a cost of $7.5 million resulting in the resource announced today. Significantly, the property is not burdened with royalties thus enhancing the economics of mining and processing.

Aggregate acquisition and exploration expenses of $11.1 million, much of which has been contributed by our joint venture partners, equate to a “finding” cost of $0.10 per silver equivalent ounce. Expenditure of an additional US$ 3 million to be provided by Electrum on the next phases of drilling, exploration and development will undoubtedly further enhance the value of the property with programs to enhance both the class and quantity of current resources in the Blind, El Sol and Santo Nino deposits and specifically, the recent high grade discovery at Mina La Bocona.”

Resource Model Highlights

Three separate deposits comprising sets of sub-parallel, northwest-trending and steeply dipping zones were modeled using mineralized intercepts and geological information from Southern’s exploration work on the property from 2011 to 2015. The modelled deposits extend over a 1 kilometer strike-length and up to 600 metres depth. Thick intercepts of high-grade mineralization in the 2015 drill holes 15CLM-25 (12.8m est. true thickness averaging 113g/t Ag, 0.5g/t Au, 0.4% Cu, 0.9% Pb and 3.6% Zn) and 15CLM-81 (8.7m est. true thickness averaging 136g/t Ag, 0.5% Cu, 0.3% Pb, 4.5% Zn) highlight the continued exploration potential of the mineralizing system for an additional 500 metres along strike and to the southeast. Mineralization is open at depth in all three deposits.

Resources in the indicated category comprise approximately 36% of the total tonnage calculated in this estimate, with much of the indicated resources near surface and within the upper 250 metres of the Blind and the El Sol Deposits.

Significantly, the current resource does not include any drill results from the east side of the Central Intrusion in the area of the Mina La Bocona target which to date remains un-modelled. Drilling at Mina La Bocona in 2015 returned thick high-grade zones of mineralization including a 3.9m est. true thickness of 13.5g/t Au, 37g/t Ag, 2.2% Pb and 1.7% Zn (1093g/t AgEq)and an 8.2m est. true thickness of 0.5g/t Au, 150g/t Ag, 3.7% Pb and 0.7% Zn (325g/t AgEq) in drill hole 15CLM-078 (see NR-10-15, October 01, 2015). Further drilling on the Mina La Bocona target is planned for the 2016 exploration program in order to properly delineate this target.

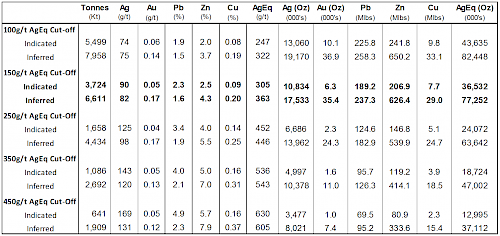

KGL suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a 150g/t AgEq cut-off value for the base-case resource estimate. Also reported are 100g/t, 150g/t, 250g/t, 350g/t and 450g/t AgEq cut-off values (see Table 2), which demonstrate both a significant increase in tonnage and contained precious- and base-metals at the lower 100g/t AgEq cut-off value and significant increases in precious and base-metal grades at incrementally higher cut-off values. A NI 43-101 Technical Report will be posted on Sedar within 45 days.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. There is no assurance that any part of the Inferred Resource will be converted to Measured or Indicated Mineral Resources or ultimately converted to a Mineral Reserve.

2016 Exploration Program

Management is pleased with the results received to date from the exploration and definition drilling program on the Cerro Las Minitas project. Compilation and analysis of the 2015 results continues toward planning of the 2016 exploration program on the property with Southern as the operator, the details of which will be announced shortly. Electrum has contributed a total of US$2.0 million expended on exploration and earned a 30% indirect interest in the Cerro Las Minitas project. Electrum has the right to earn an additional 20% indirect interest by expending US$1.5 million in exploration expenditures in the succeeding 30 months of the option term. A final 10% indirect interest may be earned by it expending an additional US$1.5 million in exploration expenditures during this time period.

Priorities for the upcoming 2016 exploration program will continue to define the overall size of the project and include:

- drill testing the down dip and the southeastern extensions of the Blind and El Sol mineralized zones;

- further extension and delineation of high-grade, precious-metal enriched mineralization at the Mina La Bocona target on the eastern side of the Central Intrusion; and

- the identification of new discoveries throughout the district-wide property package.

Cerro Las Minitas Resource Parameters

The estimate was carried out using a block model constrained by 3D wireframes of the individual mineralized zones. The block model is comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Ag, Au, Cu, Pb and Zn interpolated using Inverse Distance to the Second Power (ID2) weighting. Silver equivalent values were subsequently calculated from the interpolated block grades.

The interpolation was carried out in 3 passes using progressively larger search radii to a maximum of 100m x 100m x 25m. For all passes, the interpolation was restricted to a minimum of 1 and a maximum of 8 composites, with a maximum of 4 composites from any one drill hole (i.e. a minimum of two drill holes required for +4 composites).

Bulk densities were based on a total of 106 individual measurements taken by Southern field personnel from nine mineralized zones ranging from 2.9m to 10.9m in thickness. These density values ranged from 2.51 t/m3 to 4.15 t/m3. However, an average value of 2.85 t/m3 was used as it was thought to representative of the densities within the Blind, El Sol and Santo Nino zones.

Only silver values have been capped in order to remove the effects potential overestimation due to statistical outliers. The threshold chosen was 600 g/t silver. Analysis was performed to determine if grade limiting was necessary for the other constituent metals and it was determined that this was unnecessary.

Table2: Summary of Mineral Resources at the Cerro Las Minitas Project, Durango State, Mexico

Notes:

1) The current Resource Estimate was prepared by Garth Kirkham, P.Geo., of Kirkham Geosystems Ltd.

2) CIM definitions were followed for classification of Mineral Resources

3) Mineral resources were constrained using mainly geological constraints and approximate 10g/t AgEq grade shells

4) Mineral Resources were estimated using a long-term prices of prices of $15/oz silver, $1,100/oz gold, $2.75/lb Cu, $0.90/lb lead and $0.90/lb zinc and metal recoveries of 82% silver, 86% lead and 80% zinc. All prices are stated in $USD.

The mineralized zones were initially defined by Southern personnel and then validated and refined by KGL. The mineralized wire frames were defined using a combination of geological constraints, grade threshold of approximately 10 g/t AgEq grade cut-off and no minimum thickness.

For all zones, blocks are classified as Inferred if they fell within 100m of a drill hole intercept. Blocks within 50 m of the nearest intercept, and estimated by at least two drill holes were classified as Indicated. However, an interpreted boundary is the final determination of indicated resources in order to remove “spotted dog” effect.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world class mineral deposits in north-central Mexico and the southern USA with specific emphasis on the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata which hosts multiple world class mineral deposits such as Penasquito, San Martin, Naica and Pitarilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint venture relationships, in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA.

Robert Macdonald, MSc., P.Geo., is a Qualified Person as defined by National Instrument 43-101 and he is responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation and review of the technical results in this disclosure. Garth Kirkham, P.Geo., and Principal of Kirkham Geosciences Limited is the Independent Qualified Person responsible for the preparation and disclosure of the Mineral Resource Estimate.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.