Southern Silver Exploration Corp. (TSX.V:SSV) (“Southern Silver”) reported today that it continues to identify high-grade mineralization from the current core drilling program on the Cerro Las Minitas project, Durango State, Mexico. Recent drilling has identified two thick intervals of mineralization in hole 17CLM-101 opening up the potential for significant extensions to the Blind Zone and Skarn Front deposits to the southeast of their currently drill extents. Highlights from hole 17CLM-101 include:

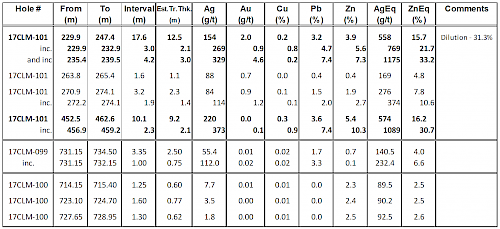

- a 17.6m down hole interval (12.5m est. True Thickness) averaging 154g/t Ag, 2.0g/t Au, 3.2% Pb and 3.9% Zn (558g/t AgEq; 15.7% ZnEq) starting at 229.9m downhole, including a higher grade 4.2m interval (3.0m est. TT) averaging 329g/t Ag, 4.6g/t Au, 7.4% Pb and 7.3% Zn (1175g/t AgEq; 33.2% ZnEq); and

- a 10.1m down hole interval (9.2m est. TT) averaging 220g/t Ag, 0.3% Cu, 3.6% Pb and 5.4% Zn (574g/t AgEq; 16.2% ZnEq) starting at 462.5m down hole, including a higher grade 2.3m interval (2.1m est. TT) averaging 373g/t Ag, 0.9% Cu, 7.4% Pb and 10.3% Zn (1089g/t AgEq; 30.7% ZnEq).

The upper mineralized intercept in hole 17CLM-101 is spatially related to thick intervals of monzonite/felsite and appears to be the southeast extension of the Blind Zone deposit. The deeper intercept is an approximate 125 metre lateral offset from mineralization in 11CLM-025 (10.8m down hole of 182g/t Ag, 0.5% Cu, 1.6% Pb and 6.4% Zn) and is localized along the leading edge of the skarn surrounding the Central Intrusion (Skarn Front zone). Neither hole 11CLM-025 nor the hole located immediately to the southeast of 17CLM-101 (12CLM-040) tested the Blind Zone target.

Results from hole 17CLM-101 are significant in:

- the identification of relatively shallow, precious-metal-enriched mineralized intervals in two separate zones which remain open and largely untested for over 500 metres laterally to the southeast and for up to 500m down dip from hole 17CLM-101; and

- the identification of gold values (up to 4.6g/t Au over 3.0m est. TT) in the upper interval which is of particular geological interest in further enhancing the value of the newly discovered intercept.

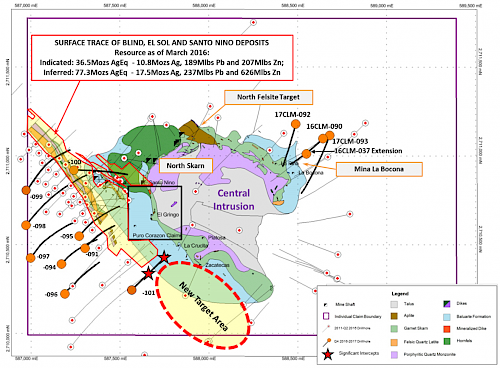

Approximately 10,650 metres in 14 drill holes has now been completed in the planned US$2 million 2017 exploration program. Drilling will continue through July on both the North Skarn target and extensions of the Blind and Skarn Front zones to the southeast.

Table 1: Select Composites from 2016-17 Drilling on the Cerro Las Minitas Property

Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP analysis, High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>20%) and Zn (>30%) overlimits assayed by titration. AgEq and ZnEq were calculated using average metal prices of: US$18.2/oz silver, US$1240/oz gold, US$2.8/lbs copper and US$0.91/lbs lead and US$0.94/lbs zinc. AgEq and ZnEq calculations did not account for relative metallurgical recoveries of the metals. Ore-grade composites calculated using a 80g/t AgEq cut-off and <20% internal dilution, except where noted; anomalous intercepts calculated using a 10g/t AgEq cut-off.

Figure 1: Plan Map showing the distribution of Drill Holes at Cerro Las Minitas for the 2017 core drilling program

Cerro Las Minitas Project

Exploration on the company’s flagship Cerro Las Minitas property, Durango Mexico is funded by Electrum Global Holdings L.P. (“Electrum”), which has financed a broad range of exploration activities and has earned a 60% interest in the project through a US$5.0M earn-in on the property, with Southern Silver acting as operator.

The Cerro Las Minitas project as of March 21st, 2016 contains an estimated Inferred Resource of 17.5Mozs silver and 237Mlbs of lead and 626Mlbs zinc (77.3Mozs AgEq) and an estimated Indicated Resource of 10.8Mozs silver, 189Mlbs lead and 207Mlbs zinc (36.5Mozs AgEq).(1)

A total of 104 drill holes for 46,351 metres have now been completed on the Cerro Las Minitas project with exploration expenditures of approximately US$10.8 million.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA.

- The 2016 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn and AgEq values interpolated using ID2 weighting. The models identified at a 150g/t AgEq cut-off, an indicated resource of 3,724,000 tonnes averaging 90g/t Ag, 0.05g/t Au, 2.3% Pb, 2.5% Zn and 0.09% Cu and a cumulative inferred resource of 6,611,000 tonnes averaging 82g/t Ag, 0.17g/t Au, 1.6% Pb, 4.3% Zn and 0.2% Cu. Mineral Resource cut-offs are estimated using an average long-term price of $15/oz silver, $1,100/oz gold, $2.75/lb Cu, $0.90/lb lead and $0.90/lb zinc and metal recoveries of 82% silver, 86% lead and 80% zinc. AgEq calculations did not account for relative metallurgical recoveries of the metals. All prices are stated in $USD. Mineral Resources are conceptual in nature and as such do not have demonstrated economic viability.

The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.