Southern Silver Exploration Corp. (TSX.V: SSV) (“Southern Silver”) reported today that drill crews have mobilized to the Area of the Cerro project to complete final preparations in advance of the arrival of the drill. The work is part of Southern Silver’s $3 million 2018 exploration program on Cerro Las Minitas and will target both systematic resource expansion in the Area of the Cerro which contains the existing Mineral Resource Estimate and drilling of new discoveries in the recently staked CLM West claim group. A second drill will be mobilized for the CLM West Au-Ag epithermal claim area upon completion of the current surface exploration targeting program allowing the company to test both target areas simultaneously.

The Cerro Las Minitas project operates on a joint venture basis by Southern Silver at a 40% interest and Electrum Global Holdings LP (Electrum) at a 60% interest. Southern Silver remains operator of the project. Since formation of the Joint Venture, the partners have approved over US$3.5 Million in exploration on the project since September, 2017.

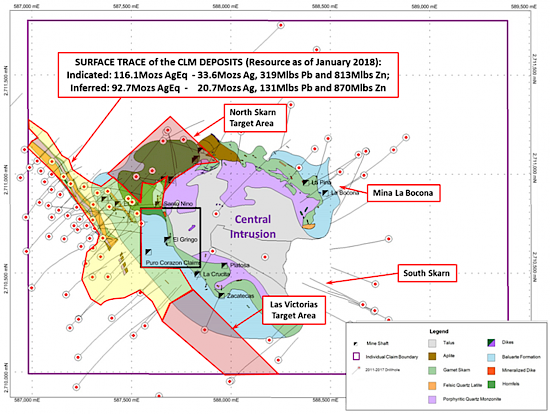

Cerro Las Minitas Deposits - Area of the Cerro

Up to 10,000 metres of core drilling is budgeted in 2018 to develop and extend high grade trends within the Skarn Front deposit and will also include several fences of holes stepping out to the southeast in the Las Victorias target area and along strike to the northeast in the North Skarn zone.

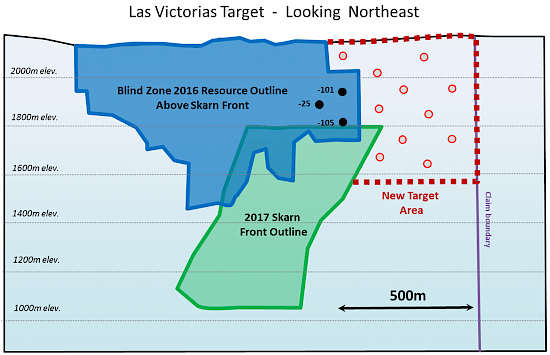

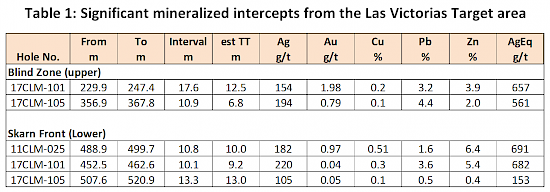

Initial drilling will begin at the Las Victorias target and will systematically offset high-grade mineralization previously identified in holes 11CLM-025, 17CLM-101 and 17CLM-105

Mineralization in the Las Victorias zone is open for approximately 500 metres along strike to the southeast of drill holes 17CLM-101 and -105. Two separate mineralized zones are identified in these holes which are believed to be the lateral extensions of the Blind and Skarn Front zones respectively. As presently modelled, mineralization in Las Victorias zone is open laterally to the southeast and to depths of up to 500 metres.

Figure 1: 2018 drill targets, Area of the Cerro, Cerro Las Minitas project

Figure 2: Schematic Long-section of proposed drill targeting on the Las Victorias target

Table 1: Significant mineralized intercepts from the Las Victorias Target area

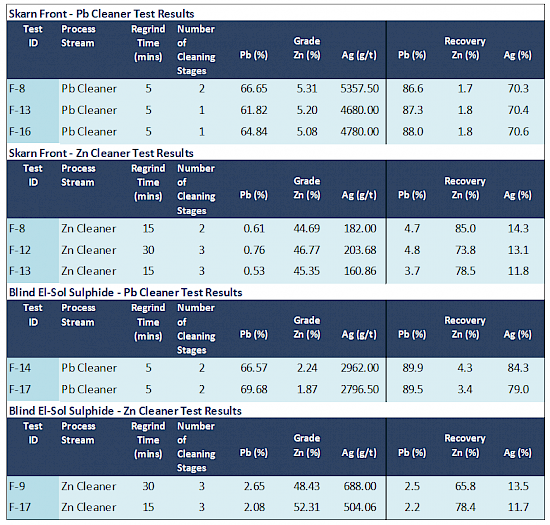

Cerro Las Minitas Metallurgical Results

Recently completed Metallurgical test work was successful in separating both lead and zinc concentrates from both of the Skarn Front and Blind - El Sol sulphide composites. Silver was recovered to the lead concentrate and averaged 70% for the Skarn Front material and 82% for the Blind – El Sol sulphides. Lead recoveries remained high and averaged 87% in the Skarn Front and 90% in the Blind – El Sol concentrates.

Three stages of cleaning were required to increase overall zinc performance in the test work with the best results from the Skarn Front material returning recoveries of 74% Zn to 85% Zn and grading from 44% to 46.7% Zn. Minimal lead cleaning was required to produce high concentrate grades of over 60% Pb in the lead concentrate. Silver which partitions into the lead concentrate returned grades of over 2500g/t Ag in the Blind El Sol and over 4500g/t Ag in the Skarn Front.

The Metallurgical test work on representative composites from the Cerro Los Minitas mineral deposits was conducted by Blue Coast Research of Parksville, BC which visited the project in October 2017 to supervise the selection of samples for use in the study. Representative samples of the Blind – El Sol oxides and sulphides as well as the Skarn Front sulphides were collected from drill core and combined into three distinct composites to represent the three different styles of mineralization currently identified on the project. Test work included sample characterization and batch flotation tests. A limited cyanidation test program was conducted on the Blind – El Sol oxide composite.

Sample characterization of the composites included head analyses, chemical characterization, modal mineralogy determinations (including microprobe work) and Bond Ball Work Index tests.

The dominant mineral phases in the sampled material are calcite and orthoclase, with significant quantities of garnet and quartz. Sulphide minerals represent 18.1% of the Skarn Front composite and 23.5% of the Blind-El Sol sulphide composite. Major sulphide minerals include sphalerite, pyrite and galena. Significant arsenopyrite is present in the Blind – El Sol sulphide composite, but was effectively rejected during flotation.

A single Bond Ball Work test was conducted on each composite. Bond Work Mill Indices ranged from 12.3 to 12.8 (kWh/tonne) for the two sulphide composites.

The Blind - El Sol oxide composite was subjected to a limited test program. Whole ore cyanidation tests averaged 74% Ag recover. Lack of sulphide minerals in the oxide material meant that flotation was ineffective and resulted in poor recoveries for lead and zinc.

Management is pleased that the results demonstrate the separation of the lead-silver and zinc into two composites and the effective rejection of deleterious minerals such as arsenopyrite. Cleaner tests resulted in upgrading of both the lead and the zinc concentrates. The work remains preliminary and further test work on the composites will evaluate the benefits of alternate collectors, the potential separation of copper and of pyrite depression during zinc flotation and locked –cycle tests on both the Blind-El Sol and Skarn Front composites.

Table 2: Select cleaner test results from the Skarn Front and Blind – El Sol deposits

Cerro Las Minitas Project

Recent exploration on the company’s flagship Cerro Las Minitas property, Durango Mexico has been funded by Electrum Global Holdings L.P. (“Electrum”), which has now earned a 60% indirect interest in the property through a US$5.0M earn-in on the property, with Southern Silver acting as operator of joint venture operations.

The Cerro Las Minitas project as of January 8th , 2018 contains an estimated Indicated Resource, at a 175g/t AgEq cut-off, of 33.6Mozs silver and 319Mlbs of lead and 813Mlbs zinc (116.1Mozs AgEq) and an estimated Inferred Resource of 20.7Mozs silver, 131Mlbs lead and 870Mlbs zinc (92.7Mozs AgEq).(1)

A total of 108 drill holes for 49,600 metres has now been completed on the Cerro Las Minitas project with exploration expenditures of approximately US$15.5 million equating to exploration cost of $0.07 per AgEq ounce. A further US$3.0 million is budgeted for 2018 exploration.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica, Los Gatos and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine.

The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA. The Oro property consists of patented land, State leases and BLM located mineral claims which cover a highly prospective quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry centre and distal sediment-hosted, oxide-gold target.

- The 2018 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn and AgEq values interpolated using ID2 weighting. The models identified at a 175g/t AgEq cut-off, an indicated resource of 10,135,000 tonnes averaging 102g/t Ag, 0.1g/t Au, 1.4% Pb, 3.6% Zn and 0.15% Cu and a cumulative inferred resource of 8,685,000 tonnes averaging 74g/t Ag, 0.04g/t Au, 0.7% Pb, 4.5% Zn and 0.15% Cu. Mineral Resource cut-offs are estimated using an average long-term price of $16/oz silver, $1,200/oz gold, $2.75/lb Cu, $1.00/lb lead and $1.10/lb zinc and metal recoveries of 82% silver, 86% lead 80% copper and 80% zinc. AgEq calculations did not account for relative metallurgical recoveries of the metals. All prices are stated in $USD. Mineral Resources are conceptual in nature and as such do not have demonstrated economic viability.

The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.