Southern Silver Exploration Corp. (TSX.V:SSV) (“Southern”) reported today that it has filed a technical report (“Report”) prepared in accordance with Canadian Securities Administrators’ National Instrument 43-101. The Report may be found under the Company’s profile at www.sedar.com and on Southern’s website, www.southernsilverexploration.com.

The Report, dated June 24th, 2019, entitled “NI 43-101 Technical Report, Mineral Resource Estimate for Cerro Las Minitas Project, Durango State, Mexico ” was prepared by Garth D. Kirkham, P.Geo., following the guidelines of NI 43-101 and NI 43-101F1.

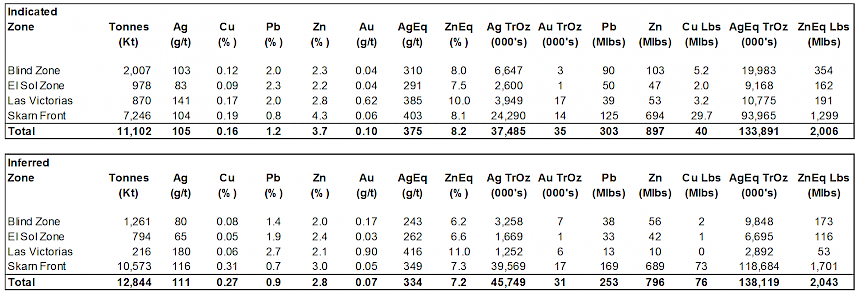

The resource estimate provides updated grade and tonnage estimates for four mineral deposits on the property at the Blind, El Sol, Las Victorias and Skarn Front zones which have been the focus of much of Southern’s exploration activities on the property since 2011. The Report supports the disclosure made by the Company in its news release dated May 9, 2019 “Southern Silver Increases Mineral Resource at Cerro Las Minitas to: Indicated 134Mozs AgEq or 2.0Blbs ZnEq: 37.5Mozs Ag, 303Mlbs Pb, and 897Mlbs Zn; and Inferred 138Mozs AgEq or 2.0Blbs ZnEq: 45.7Mozs Ag, 253Mlbs Pb, and 796Mlbs Zn”

There are no material differences in the mineral resources contained in the Report from those disclosed in the May 9, 2019 news release.

Report Highlights

Compared to the 2018 Mineral Resource estimate, the 2019 update, at a 175g/t AgEq cut-off, features:

- Indicated Mineral resources - 134 million ounces silver equivalent or 2.0 billion pounds zinc equivalent. A 0.97Mt increase to 11.1Mt averaging 105g/t Ag, 0.1g/t Au, 0.16% Cu, 1.2% Pb and 3.7% Zn (375g/t AgEq; 8.2% ZnEq), containing: 37.5 million ounces of silver; 35 thousand ounces of gold; 40 million pounds of copper; 303 million pounds of lead; and 897 million pounds of zinc.

- Inferred Mineral resources - 138 million ounces silver equivalent or 2.0 billion pounds zinc equivalent. A significant increase to 12.8Mt averaging 111g/t Ag, 0.07g/t Au, 0.27% Cu, 0.9% Pb and 2.8% Zn (334g/t AgEq; 7.2% ZnEq) containing: 45.7 million ounces of silver; 31 thousand ounces of gold; 76 million pounds of copper, 253 million pounds of lead; and 796 million pounds of zinc.

This new Mineral Resource Estimate illustrates the continuity of the mineralization and continued expansion of the mineral deposit in the Cerro Las Minitas project and updates the previously reported January 2018 estimate. The new Resource Estimate incorporates additional data from a very successful drilling program of 10,157 metres in 2018/19, updated metal recoveries and pricing, application of a more rigorous specific gravity (“SG”) measurement protocol and further refinement of the resource wire frames.

Table 1: Base-case Mineral Resource Estimate for CLM Project Utilizing a 175g/t AgEq cut-off value:

Notes: The 175g/t AgEq cut-off value was calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. The base case cut-off grade assumed $75/tonne operating, smelting and sustaining costs. All prices are stated in $USD.

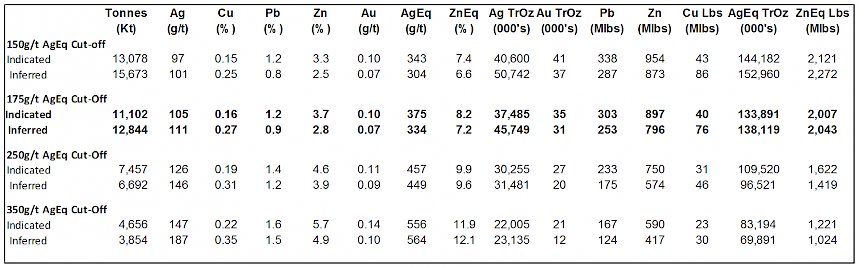

Table2: Mineral Resource Cut-off Sensitivities for CLM Project

Notes:

- The current Resource Estimate was prepared by Garth Kirkham, P.Geo., of Kirkham Geosystems Ltd.

- All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument 43-101 (“NI43-101”).

- Mineral resources were constrained using mainly geological constraints and approximate 10g/t AgEq grade domains.

- AgEq cut-off values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 25% gold, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 18% gold, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. Base case cut-off grade assumed $75/tonne operating smelting and sustaining costs. All prices are stated in $USD.

- Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. The same methodology was used to calculate the ZnEq value.

- Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Model Parameters

Four separate mineral deposits were modelled in the resource update with the Blind, the El Sol and the Las Victorias deposits forming sets of sub-parallel, northwest-trending and steeply dipping mineralized zones which are traced for over 1300 metres strike and up to 600 metres depth. The fourth deposit known as the Skarn Front, forms beneath the Blind, El Sol and Las Victorias deposits and is localized on the outer edge of the skarn alteration zone surrounding the Central Monzonite Intrusion and has been drilled along an approximate 1100 metre strike length and to depths of up to 1000 metres.

KGL suggests that an underground mining scenario is appropriate for the project at this stage and has recommended a 175g/t AgEq cut-off value for the base-case resource estimate. Also listed are grade-tonnage sensitivities at 150g/t, 175g/t, 250g/t, and 350g/t AgEq cut-off values (see Table 2 above) which demonstrate both a significant increase in contained precious and base-metals at lower cut-off values and good tonnage and grade retention at incrementally higher cut-off values. A NI 43-101 Technical Report will be posted on SEDAR within 45 days.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. There is no assurance that any part of the Inferred Resource will be converted to Measured or Indicated Mineral Resources or ultimately converted to a Mineral Reserve.

2018-19 Exploration Review:

Drilling in the 2018-19 Exploration season, as reflected in the updated Mineral Resource estimate, successfully:

- filled grade gaps in the earlier block model and allowed the more effective projection of higher grade mineralization throughout the deposits;

- built continuity of several higher grade zones within the central part of the Skarn Front deposit establishing several high-grade lenses of mineralization within 400 metres of surface;

- established greater continuity between the Skarn Front deposit and footwall mineralization (lateral to and equivalent to the Skarn Front style mineralization) in the Las Victorias zone;

- extended and built continuity of higher-grade, shallow mineralization (<400 metres) in both the Las Victorias deposit and North Skarn zone;

- added 163Kt Indicated Resource and 216Kt Inferred Resource at grades >380g/t AgEq in the Las Victorias deposit;

- added 2.1Mt Indicated Resource and 2.7Mt Inferred Resource to the Skarn Front deposit at similar or higher average AgEq grade;

- provided better definition of three higher grade sub-zones within the El Sol deposit; and

- identified anomalous silver and pathfinder mineralization in the CLM West Epithermal 19,500 ha. claim group located approximately 10-15km to the southwest of the established mineral resources on the CLM property

The Mineral Resources at Cerro Las Minitas have increased substantially since the initial resource estimate in 2016 with 133 drill holes for 59,000 metres, US$18.5M spent to date and with a discovery cost of: $0.07/oz AgEq; $0.005/lb ZnEq.

The project continues to provide a strong high-grade resource growth projection.

2019 Exploration Program

Compilation and analysis of the 2018-19 results continues toward further drill targeting for the 2019-20 exploration program with Southern as the operator. New targeting has identified additional exploration potential on-strike to the southeast of the Las Victorias zone and on the eastern side of the Central Intrusion which has receive only limited drill testing to date.

Sample selection for variability test work, following the previously announced metallurgical results on the Skarn Front composite (see NR-10-18) is underway. The previous work resulted in the successful separation of a potential “saleable grade” copper concentrate and the generation of a cleaner zinc concentrate grading above 50% zinc without sacrificing zinc, lead or silver recoveries. The new test work will look to confirm these earlier results and further test a range of grades and metal ratios to help define the potential “payables” in different parts of the known deposits.

The overall objective of the 2019-20 exploration program is to continue to increase the existing resource base and to identify and drill test new epithermal vein systems within the larger claim package.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica, Los Gatos and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine.

The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA. The Oro property consists of patented land, State leases and BLM located mineral claims which cover a highly prospective quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry center and distal sediment-hosted, oxide-gold target.

Robert Macdonald, MSc., P.Geo., is a Qualified Person as defined by National Instrument 43-101 and he is responsible for the supervision of the exploration on the Cerro Las Minitas Project and for the preparation and review of the technical results in this disclosure. Garth Kirkham, P.Geo., and Principal of Kirkham Geosciences Limited is the Independent Qualified Person responsible for the preparation and disclosure of the Mineral Resource Estimate.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.