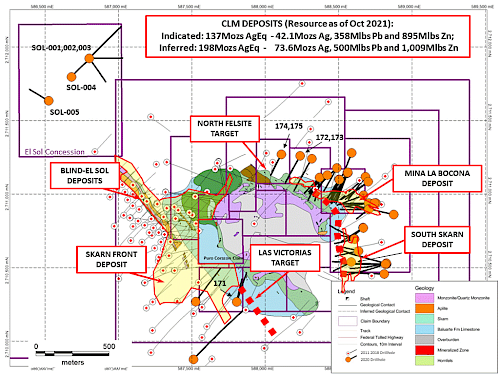

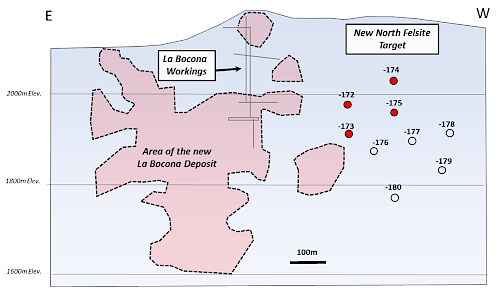

Southern Silver Exploration Corp. (TSX.V: SSV) (“Southern Silver”) reported today on further assay results from the Mina La Bocona target on the Cerro Las Minitas project, Durango, Mexico. These latest drill results are from the North Felsite chimney, an area located approximately 400 metres to the northwest of the La Bocona and Mina Pina shafts along the eastern side of the Cerro.

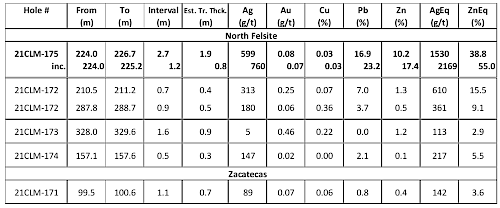

The newly released polymetallic sulphide intercepts from the Mina La Bocona target area include:

- a 1.2 metre interval (0.8 metre est. TT.) averaging 760g/t Ag, 23.2% Pb and 17.4% Zn (2169g/t AgEq) within a 2.7 metre interval (1.9 metre est. TT.) averaging 599g/t Ag, 16.9% Pb and 10.2% Zn (1530g/t AgEq) from drill hole 21CLM-175; and

- a 0.7 metre interval (0.4 metre est. TT.) averaging 313g/t Ag, 0.3g/t Au, 7.0% Pb and 1.3% Zn (1011g/t AgEq) from drill hole 21CLM-172

These recent results were returned from an area 200m along strike and to the northwest of previously reported sulphide intercepts from 21CLM-167 (1.3m of 513g/t AgEq; see NR-15-21) and 21CLM-164 (10.8m of 234g/t AgEq; see NR-15-21) and have now extended the projection of mineralization beyond the newly modelled La Bocona deposit and into the North Felsite Target area. Mineralization remains open along strike and at depths below 250 metres.

Exploration on the CLM property continues with one drill operating. Five additional drill holes totalling 2,093 metres have now been completed in the North Felsite target area, down dip and along strike of the high-grade intercept identified in hole 21CLM-175 reported above. Five holes totalling 1,975 metres have also been completed on the El Sol concession located 2500 metres to the northwest of the La Bocona deposit as part of the company’s Greenfields exploration program. Here, drilling targeted northwest and northeast-trending mineralized structures identified in earlier surface mapping and sampling. Assay results from these additional ten holes are pending and publication is anticipated over the coming weeks.

Rob Macdonald, Vice President Exploration stated: “These latest assay results demonstrate the continued exploration potential of the CLM project with drilling at the North Felsite target showing a potential promising extension to the already significant mineral resources identified in the La Bocona deposit while new target areas such as those on the EL Sol concession continue to be developed. Drilling continues and further assay results are anticipated over the coming weeks.”

Figure 1: Plan Map of the Area of the Cerro showing the distribution of the CLM deposits and the location for new drill targeting, at the North Felsite target and El Sol concession.

Figure 2: Longitudinal Section of the La Bocona and North Felsite areas showing the distribution of Southern Silver’s most recent drill holes.

Table 1: Select Assay Intervals from Mina La Bocona and South Skarn targets:

Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP analysis, High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>20%) and Zn (>30%) overlimits assayed by titration. AgEq and ZnEq were calculated using average metal prices of: US$20/oz silver, US$1650/oz gold, US$3.25/lbs copper and US$0.9/lbs lead and US$1.15/lbs zinc. AgEq and ZnEq calculations did not account for relative metallurgical recoveries of the metals. Ore-grade composites are calculated using a 80g/t AgEq cut-off in sulphide and 0.5g/t AuEq in the oxide gold zone Composites have <20% internal dilution, except where noted; anomalous intercepts are calculated using a 10g/t AgEq cut-off.

Oro Project Update

The Company property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA, comprised of patented land, State leases and BLM mineral claims totalling 22.3 sq. km. Targeting has been finalized and bonding pending for a 4,000m drill program, designed to test several copper-molybdenum porphyry and copper-gold skarn targets within a broad quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry centre. Drilling is planned to commence in Q1, 2022.

Cerro Las Minitas Project

Southern Silver continues to advance one of the world’s largest undeveloped silver/lead/zinc resources, the Cerro Las Minitas Skarn/CRD project, through advanced exploration, pre-production metallurgical and engineering work, and economic assessment. The CLM Ag-Pb-Zn-Cu Skarn system is well located in southern Durango, Mexico, in a safe jurisdiction, surrounded by producing companies, with easy access and strong community support.

The Cerro Las Minitas project as of Oct 27th, 2021 contains a Mineral Resource Estimate, at a $60/t NSR cut-off, of (1):

• Indicated – 137Moz AgEq: 42.1Moz Ag, 44Mlbs Cu,358Mlb Pb and 895Mlb Zn

• Inferred – 198Moz AgEq: 73.6Moz Ag, 98Mlb Cu, 500Mlb Pb and 1,009Mlb Zn

The new Mineral Resource Estimate significantly increases the size of the resource on a tonnage and silver-equivalency basis making it one of the largest and higher-grade undeveloped silver-based deposits in the world. The new Resource Estimate increases silver as a proportion of the contained metals, significantly increases the NSR value of the deposits and will now form the basis for a Preliminary Economic Assessment (PEA), which is expected to be completed by Q2 2022.

A total of 180 drill holes for 81,000 metres has been completed on the CLM Project with exploration expenditures of approximately US$30.0 million.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions.

- The 2021 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 3m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID2 weighting. Silver, zinc equivalent and $NSR/t values were subsequently calculated from the interpolated block grades. The model is identified at a $NSR/t cut-off, with an indicated resource of 12,325,000 tonnes averaging 106g/t Ag, 0.07g/t Au, 1.3% Pb, 3.3% Zn and 0.16% Cu and an inferred resource of 19,605,000 tonnes averaging 117g/t Ag, 0.12g/t Au, 1.2% Pb, 2.3% Zn and 0.23% Cu. AgEq cut-off values and NSR values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.20/lb. zinc. Metal recoveries are variable as a function of deposit and concentrate and are detailed in NR-18-21, Oct 27, 2021. Base case cut-off grade assumed $60NSR/tonne operating, processing and sustaining costs. All prices are stated in $USD. Silver Equivalents, Zn equivalents and $/t NSR values were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine final values. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of the data from the CLM Project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at https://www.southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.