Southern Silver Exploration Corp. (“Southern Silver” and the “Company”) reports that it has received all approvals from the New Mexico Mining and Minerals Division, the New Mexico State Land Office, and the Bureau of Land Management to conduct an approximate 4,000-metre diamond drilling program to test several copper porphyry and skarn targets at its wholly owned Oro property, located in southwestern New Mexico, USA.

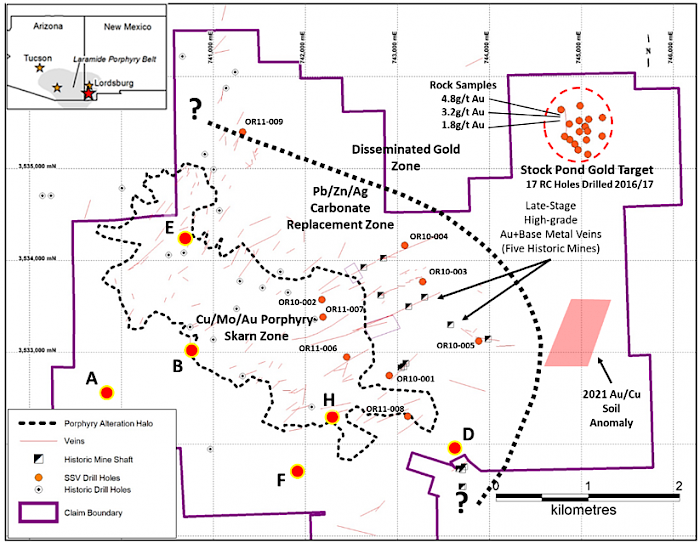

Figure 1: Selected Drill Targets (A-H) on the Oro Project

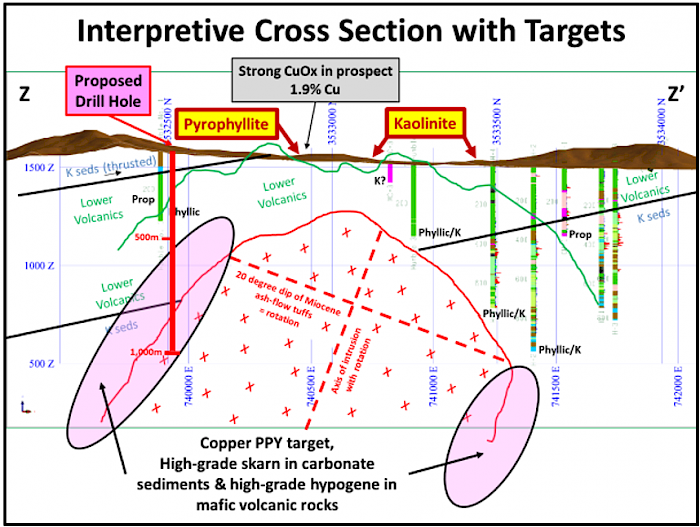

The property consists of patented land, New Mexico State leases, and Federal/BLM mineral claims acquired by purchase, staking and lease over the past several years. Several historic mines produced copper, lead, zinc, silver, and gold from discrete portions of the amalgamated property. The property covers a large, well-zoned Laramide-age mineral system consisting of a ring of Carbonate Replacement Deposits (CRDs) around a core of intense sericite-pyrite alteration, which clay mineralogy indicates is the lithocap overlying an unexposed porphyry centre. Targeting for copper mineralization is based upon 3D modelling of data generated by geologic mapping, historic drill holes, geochemical zoning studies, alteration clay zoning studies, and geophysical surveys. A 6-hole (4,000-metre) diamond drill program will focus on porphyry and skarn targets and is expected to commence early in February.

Surrounding the CRD zone are distal-disseminated, sediment-hosted, gold showings, such as at the Stockpond target, where the Company has conducted limited exploratory drilling. The drilling encountered strongly oxidized, disseminated gold mineralization beneath shallow gravel cover that was limited by a post-mineral fault which buried potential extensions beneath thick gravel cover and which remains open for further exploration.

Southern Silver also expanded the property by staking 40 new unpatented lode claims to cover a gold + copper geochemical anomaly in soils along the projection of the gold zone under gravel cover south of the Stockpond target where gravity geophysics indicates that the gravel is shallow. The new claims increase the size of the property to approximately 26 square kilometers. The soil sampling was conducted in early September, with follow-up soil lines added in October which verified the soil anomaly.

President Lawrence Page Q. C. commented, “Oro is a large district play that we have been systematically consolidating and advancing for several years, and we feel this is an opportune time to test the copper targets and potentially develop a copper resource. For several years our financing and exploration and development efforts have been concentrated at our Cerro las Minitas property in Durango Mexico where the mineral inventory of silver, lead and zinc has been increased to Indicated 137Mozs AgEq or 2.3Blbs ZnEq: 42.1Mozs Ag, 358Mlbs Pb, and 895Mlbs Zn; and Inferred 198Mozs AgEq or 3.3Blbs ZnEq: 73.6Mozs Ag, 500Mlbs Pb, and 1,009Mlbs Zn(1) with a Preliminary Economic Assessment currently being conducted by an independent consultant. Addition of a significant copper resource to our global mineral inventory, assuming success in our exploration program, would add a component to an inventory of metals which are increasingly in demand by manufacturers in the emerging energy storage and transmission industries.”

Figure 2: Interpretive Cross-section of Porphyry targets on the Oro Property

Hermanas Project

In other news, geological mapping and sampling at the Company’s recently acquired Hermanas Gold/Silver property is expected to be completed in early February. Following receipt of assays, Southern Silver will select drill sites and begin permitting an initial drilling program, planned for Q4 2022 or Q1 2023.

Figure 3: Location of Oro and Hermanas Projects in southwestern New Mexico, USA

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious and base metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and in the Southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The property portfolio also includes the 100% owned Oro porphyry copper-gold project as well as the recently acquired Las Hermanas project, both located in southern New Mexico, USA. The Oro claim package covers a large, zoned Laramide-age mineralizing system containing a number of highly prospective, drill -ready porphyry/skarn and distal gold targets. Five historic mines on the Oro property produced silver, gold, lead, and zinc at shallow levels from carbonate-replacement deposits which the company interpret as being outboard of a deeper porphyry copper deposit. The Company recently acquired an option to earn 100% interest in the Hermanas gold-silver epithermal vein system 30km east of the Oro project. The Company engages in the acquisition, exploration, and development either directly or through joint-venture relationships in mineral properties in major jurisdictions.

Robert Macdonald, MSc. P.Geo, is the VP Exploration of Southern Silver Exploration Corporation, is a Qualified Person as defined by National Instrument 43-101 and is responsible for the supervision of the Company’s exploration programs and for the preparation of the technical information in this disclosure.

(1) The 2021 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 3m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID2 weighting. Silver, zinc equivalent and $NSR/t values were subsequently calculated from the interpolated block grades. The model is identified at a $NSR/t cut-off, with an indicated resource of 12,325,000 tonnes averaging 106g/t Ag, 0.07g/t Au, 1.3% Pb, 3.3% Zn and 0.16% Cu and an inferred resource of 19,605,000 tonnes averaging 117g/t Ag, 0.12g/t Au, 1.2% Pb, 2.3% Zn and 0.23% Cu. AgEq cut-off values and NSR values were calculated using average long-term prices of $20/oz. silver, $1,650/oz. gold, $3.50/lb. copper, $1.0/lb. lead and $1.20/lb. zinc. Metal recoveries are variable as a function of deposit and concentrate and are detailed in NR-18-21, Oct 27, 2021. Base case cut-off grade assumed $60NSR/tonne operating, processing and sustaining costs. All prices are stated in $USD. Silver Equivalents, Zn equivalents and $/t NSR values were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine final values. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

On behalf of the Board of Directors

“Lawrence Page”

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver’s website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.